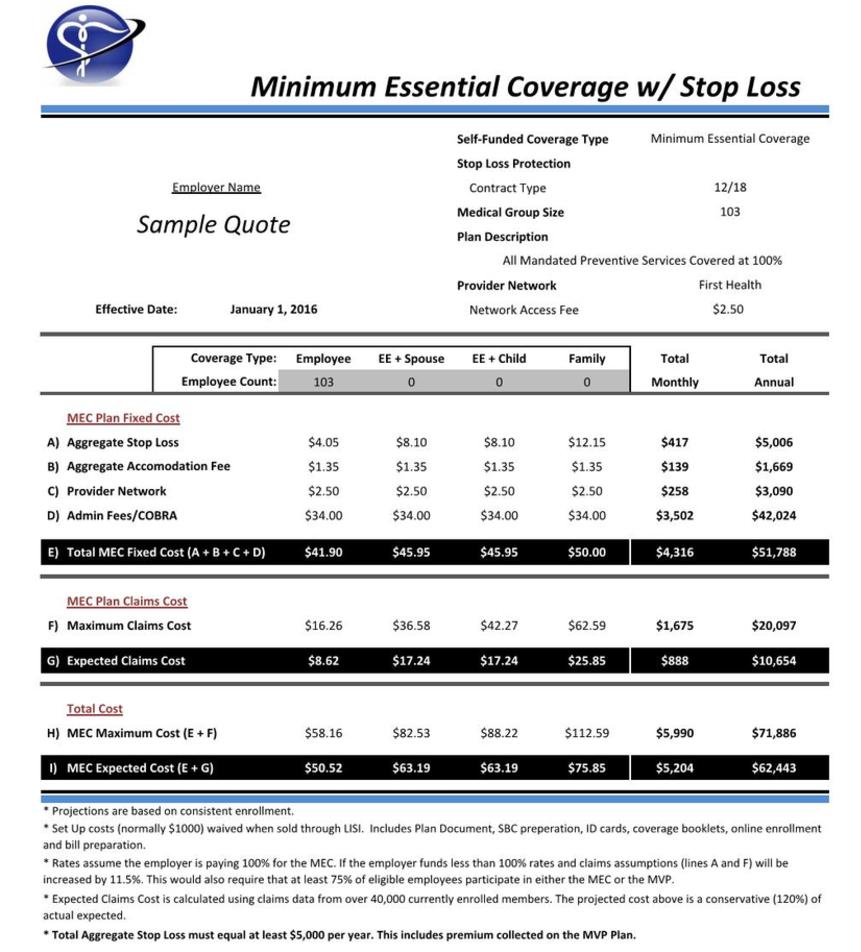

Employer Essential Coverage - For Employer size over 50 |

|

Employers must offer health insurance that is affordable and provides minimum value to 95% of their full-time employees and their children up to age 26, or be subject to penalties. This is known as the employer mandate. It applies to employers with 50* or more full-time employees, and/or full-time equivalents (FTEs). Employees who work 30 or more hours per week are considered full-time.

|