Take Control of

|

Strive Confidently To Reach Your Retirement Goals |

Partner With Experience You Can Trust |

|

See our personized programs that can help you and your employees increase their knowledge, make informed decisions & reduce financial stress.

|

With our easy-to-use planning tools, take the confusion & guess work out of planning for retirement.

|

We have over 30 years experience in helping employers find the right 401K plan. Let us compare your current plan to see if you have the best option.

|

Free Compare My Plan Tool for Employer Sponsored Retirement Plans

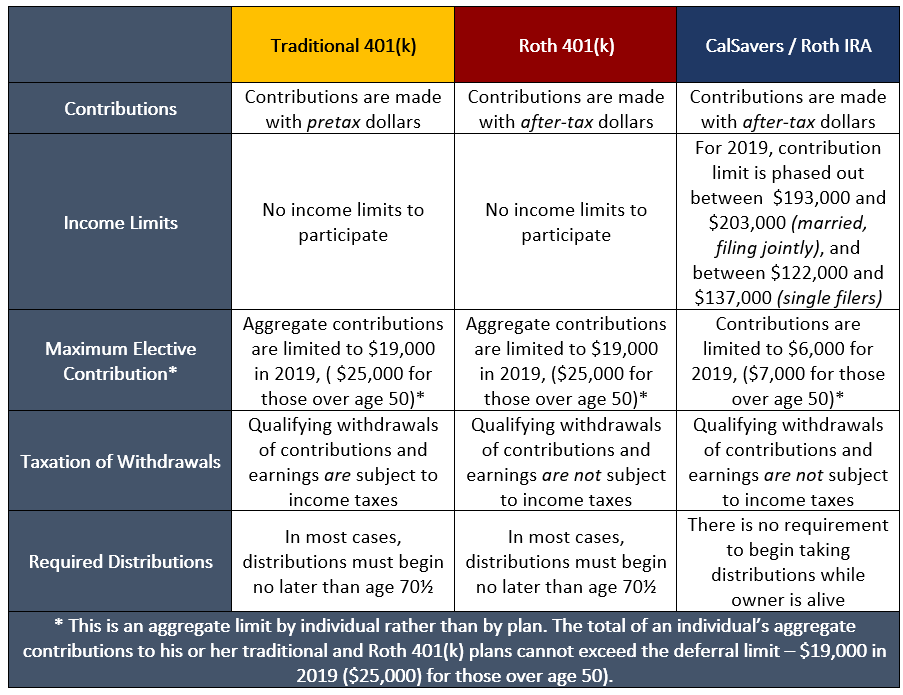

With the CalSavers deadline approaching, now’s the time for small businesses to make an important business decision: enroll in CalSavers or offer a company 401(k) plan.

A 401(k) plan may be a better option for businesses looking for:

The deadline to comply is June 30, 2022. Complete our census form below and we can let you know the most cost effective way to participate in this employer sponsored retirement plan options.

Complete the questionnaire below and we will show you which option would be better for your company.

A 401(k) plan may be a better option for businesses looking for:

- Tax incentives for employers & their employees

- More savings potential for employees, e.g. higher contribution limit & employer match

- Flexibility in plan design and investment options

- No employer fees

- Defined plan design and investment options

- Stricter plan eligibility limits (excluding select high earners)

The deadline to comply is June 30, 2022. Complete our census form below and we can let you know the most cost effective way to participate in this employer sponsored retirement plan options.

Complete the questionnaire below and we will show you which option would be better for your company.

What happens if an employer misses the registration deadline?Employers who miss the deadline will pay a fine of $250 per eligible employee if noncompliance extends 90 days or more after the notice; that increases to an additional $500 per eligible employee if noncompliance extends 180 days or more after the notice.

Have a current 401K plan?

Use our free 401K plan scorecard report to compare your 401K plan to it's benchmarks - Click here

Whether your business is starting its first 401(k) plan or is looking to transfer a long-established retirement plan, Trillium Advisory Group offers flexible retirement plan options and plan administration to meet your organization’s needs. Our 401K plan services accommodate companies of all sizes—from owner-only businesses to those with hundreds of employees, there are no minimum employee counts or minimum account balances required.

Trillium Advisory Group can also compare your current 401K plan to see if your plan investments are performing competitively to its peer group benchmark. 401K fees are inline with industry averages and not 'fee-heavy' which a lot of older plans are and employers are unaware. Employee access and communications are available, easy to understand, and allows for flexibility and access.

If your small business can’t decide between CalSavers and 401(k), consider these questions:

- Are you looking to offer an employer match?

- Do you want tax incentives for you and your employees?

- Are you looking for a higher contribution limit?

- Are you looking for an option with zero employer fees?

Click here for more information on customize options

Any questions please feel free to contact us for more information [email protected]